Member-only story

January: Stock Selection, Wage Transparency & Financial Crime

This month I investigate soft data and stock selection, the debate around wage transparency and the expected rise of financial scandals in 2022.

The year has kicked off with a bang and a nose dive. Not even a month in and it’s providing all the volatility you could imagine. With markets and regulators trying to manage a changing environment that anticipates interest rate rises, a revaluation of stocks and a strong economy with 1.6 jobs for every job seeker. With all the excitement going on this month I decided to do a deep dive on soft data and stock selection, to help avoid losers and pick winners, provide some rationality to the wage transparency debate and examine the idea that 2022 could be the year of financial crime and scandal.

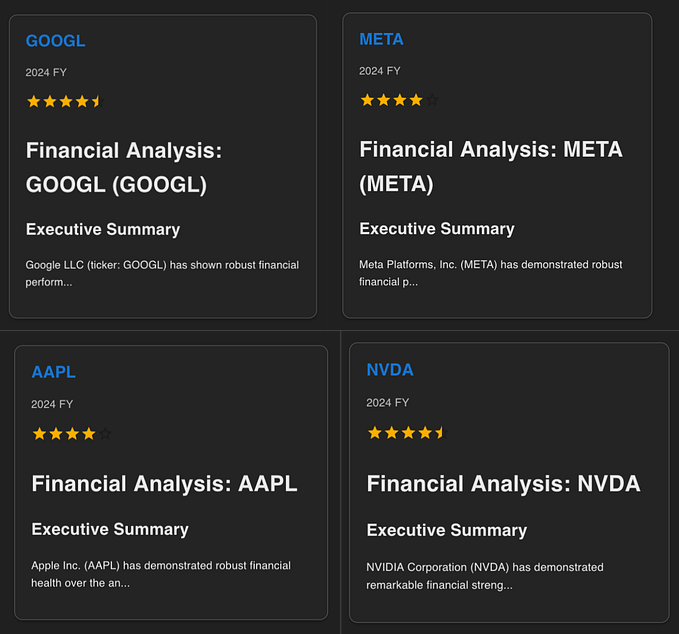

Soft Data and Stock Selection

Picking stocks and companies isn’t all about finding the right valuations, hard metrics, or charting signals. It’s easy to forget but markets are distinctly human, there’s someone else with their own thesis and reasons on the other side of that trade. My experience working in an investment bank and talking to professional traders has been that soft data often drives price more than hard data. This is particularly…